Note: This post contains affiliate links. Read my policy here.

At heart, I am a die-hard numbers nerd. So it’s a fact that I used to find actual enjoyment in creating spreadsheets to calculate the figures I entered on each year’s tax return.

Then life got more complicated.

I got married. We got a house. Had a kid. Started a business. And more. And my spreadsheet became increasingly complicated until it couldn’t keep up with my complex life and an even more complex tax code.

So, several years ago, I finally abandoned my spreadsheet and bought TurboTax to handle my taxes. And I haven’t looked back since.

Now, maybe you’re wondering if it’s right for you. Should you go old school with your tax forms, a pencil, and a trusty calculator? Should you shell out for the expertise of a CPA or other tax professional? Or should you DIY with a little help from TurboTax?

In this TurboTax review, I’m sharing the low-down on what it actually does, the pros and cons of TurboTax, and what you need to know before you decide to use it.

What is TurboTax?

TurboTax is a tax preparation software produced by Intuit. The software asks you a series of questions about your year’s finances in order to fill out your state and federal tax returns for you, and it even handles the e-filing on your behalf.

TurboTax comes in a variety of flavors, so you can choose that product that best fits your financial circumstances.

First, you choose between the online version of TurboTax and the TurboTax desktop software, which is available both as an instant download or via CD once you purchase.

The online version allows you to e-file a single return. Meanwhile, the software version lets you complete as many tax filings as you wish and e-file five of those returns — an advantage if you have multiple people whose returns you’re filing.

If you choose the online version, I encourage you to compare the TurboTax online products to see which one best fits your needs. The product you ultimately choose depends on the complexity of your finances, whether you want to itemize your deductions, if you receive income as a contractor, if you receive income from investments or real estate rental, and more.

For tax year 2021 — those are the taxes you’re filing in 2022 — you can choose from TurboTax Free Edition, TurboTax Deluxe, TurboTax Premier, and TurboTax Self-Employed. As a bonus, if you’re a member of certain military groups, you may be eligible for a military discount on your TurboTax software choice.

If you choose the desktop software version of TurboTax, I recommend that you purchase through Amazon instead of through Intuit. (Year after year, my comparison shopping has always shown that Amazon offers the lowest prices on the CDs and instant downloads.)

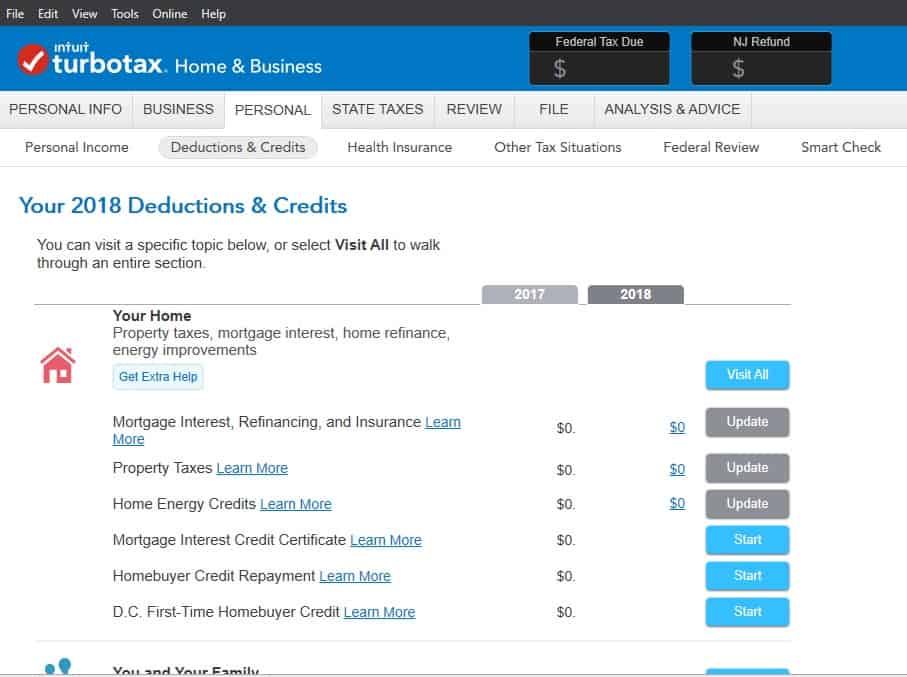

Again, before you buy, compare the TurboTax CD/download products to see which one has all the elements you need for your tax situation. You can choose from TurboTax Basic 2021 (federal taxes only), TurboTax Deluxe 2021 (federal taxes only), TurboTax Deluxe + State 2021, TurboTax Premier + State 2021, or TurboTax Home & Business + State 2021 for your personal taxes.

My TurboTax Review: 12 Things I Love

I’ve had several years to review TurboTax’s features thoroughly. Here’s why I honestly love using TurboTax to handle our family’s federal and state tax filing each year:

1. Step by step

The software makes taxes much less intimidating than a stack of forms. It asks you a series of simple questions about your family, your income, your deductions, and more to fill out the forms behind the scenes.

2. Two birds, one stone

If you purchase the federal and state tax software, TurboTax does double duty. You actually have to answer its questions just once, and your federal and state returns are filled out for you simultaneously.

3. A constant view of that all-important number

While you work toward completion of all of TurboTax’s questions, you see a constantly updated dollar figure that represents the tax you owe — or the amount to be refunded to you — at that point. And, if you’re also working on your state taxes, you’ll see that number changing as well.

4. E-filing made easy

TurboTax doesn’t just fill out your tax forms. With a few easy clicks, you can e-file state and federal taxes directly from the software interface.

5. A computerized tax professional

Though I’ve done more than my fair share of reading on the recent tax law changes, I absolutely don’t have a handle on all its intricacies. (For that matter, I don’t have a solid grasp on the complexities of the old tax law!)

TurboTax incorporates the latest tax legislation to compute your taxes correctly.

Get everything you need to create & track your budget with the Budget Planner!

6. Maximum refund guarantee

TurboTax actually comes with a maximum refund guarantee to ensure that you get every penny you’re owed.

While you enter your information, the software figures out which deductions or credits give you the best tax break. (For instance, are you better served using the standard deduction or itemizing your deductions?)

7. Ready for life’s complexities

TurboTax can handle so many financial situations.

Over the years that I’ve been using TurboTax for my family, the software has effectively dealt with the following: owning a home on which we pay a mortgage and property taxes, having a kid, contributing to HSAs and retirement accounts, contributing to charities, buying and selling investments, finalizing a Roth IRA conversion, inheriting money, earning freelance income, claiming small business deductions, paying contractors, and much more.

8. Efficiency from year to year

If you use TurboTax again after having purchased it a prior year, you can simply roll over your prior year’s data about your family makeup, where you worked, etc. TurboTax will ask you if things have changed, and — if not — you won’t have to re-enter that information.

9. Easy imports

Don’t think you have to type everything in by hand. It’s simple to download relevant tax info directly from your W-2, bank, broker, or other financial institution.

And you can easily import data directly from Quicken (your personal finance software), ItsDeductible (for itemizing charitable donations), and QuickBooks (for small business finances).

10. Clear instructions for mail-in forms

Even if you e-file, it’s possible that the federal or state government will require you to mail in some actual paperwork. If that’s the case for your tax return, TurboTax will print out exactly what you need to send and tell you where to send it.

Easy peasy.

11. Accuracy guaranteed

The accuracy of your TurboTax-generated returns is 100% guaranteed.

If you wind up owing a penalty or interest because TurboTax messed up, TurboTax will cover that cost for you.

12. Transparency

I love that TurboTax isn’t a black box that just chews up your numbers and spits out a completed return.

At any point, you can click to see where the info you’re currently entering will wind up on the actual tax forms. Plus, it’s simple to view or even print TurboTax’s calculations, completed tax forms, and summary documents for your records.

The Cons

While TurboTax does plenty of things well, there are a few downsides:

1. TurboTax handles tax filing, but not tax planning.

If you want a tool that’ll crunch the numbers, fill out your tax forms, and submit your returns, TurboTax has got you covered. But what if you want to know how to save on future taxes?

You’re looking to do some estate planning. You’re starting (or scaling) a business. You’re getting ready to retire. Or any other significant or complex life events that require tax consideration.

TurboTax can’t help you there. To make sure you’re making the right moves with your money going forward, your best bet is to consult with a real live tax professional or a financial planner.

2. There’s a definite time commitment.

If you have a super simple financial life, filing your taxes might be a snap! But, for most people, there’s a lot of heavy lifting. And, when you file your taxes yourself — even with the help of something like TurboTax — it’s going to take some time.

Now, admittedly, a good chunk of that time is spent actually rounding up the information you need — sifting through W-2 and 1099 forms, downloading your tax forms from banks and brokerage firms, looking up the amount of mortgage interest and property tax you paid last year, etc. So you’d need to expend at least that amount of time whether you used a CPA or took the DIY approach with TurboTax.

But, if you don’t have the time or patience to enter all the info and walk through TurboTax’s questions yourself, you might be better off outsourcing the process to a tax professional. Keep in mind though that you’ll pay extra for that service!

3. You might not always know what TurboTax is asking.

Usually, TurboTax is pretty clear in the questions it asks you. It’ll tell you precisely what information it wants and sometimes even where you can find it. If you’re not entirely sure what to fill in a given box, there’s almost always a button you can tap to get some additional information.

But it’s not always enough. And every once in a while, I find myself Googling an unfamiliar term TurboTax hasn’t defined. Or reading articles related to a particular tax issue, since TurboTax isn’t giving me enough info to answer one of its questions.

It’s rare, but it happens just enough to be mildly annoying each year. With a live tax pro with good availability, however, you could simply ask for clarification and get an answer.

A Few Key Things to Remember

If you decide to use TurboTax for your taxes, keep in mind these important points:

1. Garbage in, garbage out.

2. Don’t upgrade just because you have a small business.

If you run a small business or do side jobs, you may not actually need the TurboTax Home & Business software. (It’s the most expensive of the desktop software offerings for personal taxes.) If the only additional form you need to file is Schedule C, the less expensive Deluxe & Premier versions will actually output that form for you!

3. Buy it new each year.

I know the software isn’t cheap. But you truly can’t re-use last year’s TurboTax software. Tax laws (and forms) change all the time! So you’ll have to buy a new version of the software each year that you want to use TurboTax.

Have you used TurboTax? Share your experience below!

This post was originally published in March 2019 and has since been updated.

Just for your info – I used to use Turbo tax. One year I was helping a relative whose husband had died and she donated a portrait of him to the hospital that he was associated with.

Turbo Tax apparently did not know that only an amount equal to half her income could be deducted as a charitable contribution and was deducting the entire value of the painting. I caught the error and we did not file her return using Turbo tax due to same.

What was then called Tax Cut – now H&R Block – did the return correctly.

So one has to be careful that their return is being properly calculated. While this is not a common problem, it is not extremely rare one either when a family has died and items are donated and the donator’s income is not high.